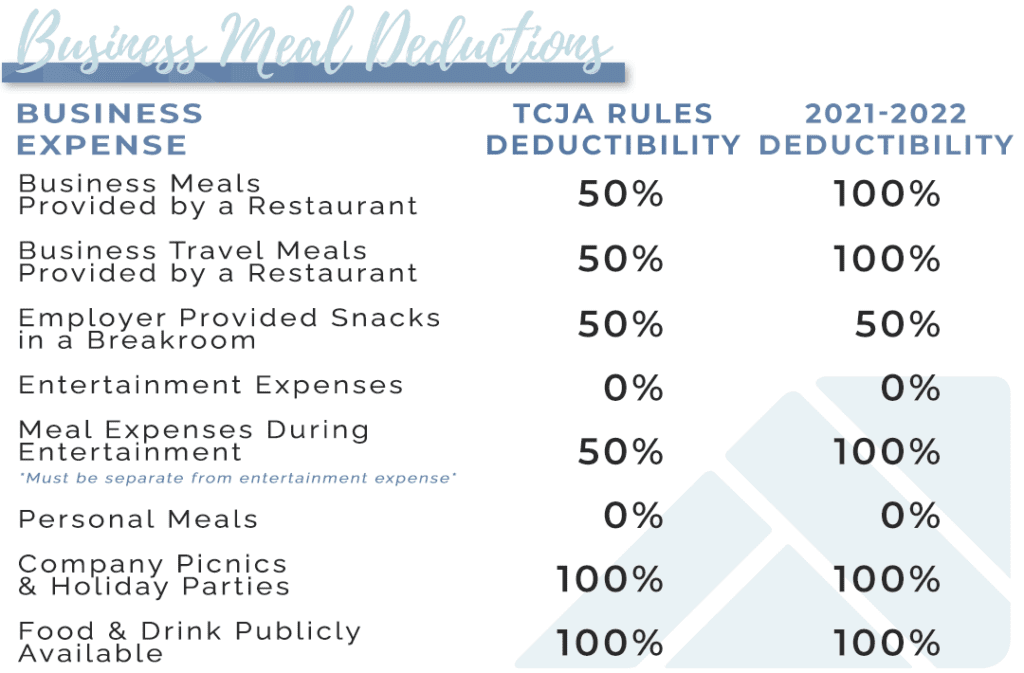

2025 Meals And Entertainment Deduction. The general rule has been and continues to be that entertainment expenses are nondeductible, and meal expenses are 50% deductible if they are not excessive. Food and beverages were 100% deductible if purchased from a restaurant in 2021 and 2022.

Friday discusses the significant tax changes set to take place after 2025, specifically regarding the meals and entertainment deduction. Knowing what meals and entertainment deductions you can take for your 2023 taxes can be pretty confusing.

2025 Meals And Entertainment Deduction Images References :

Source: lariqsarine.pages.dev

Source: lariqsarine.pages.dev

2025 Meals Deduction Binny Ursula, Deductions include deduction against salaries, against ‘.

Source: breeyvalida.pages.dev

Source: breeyvalida.pages.dev

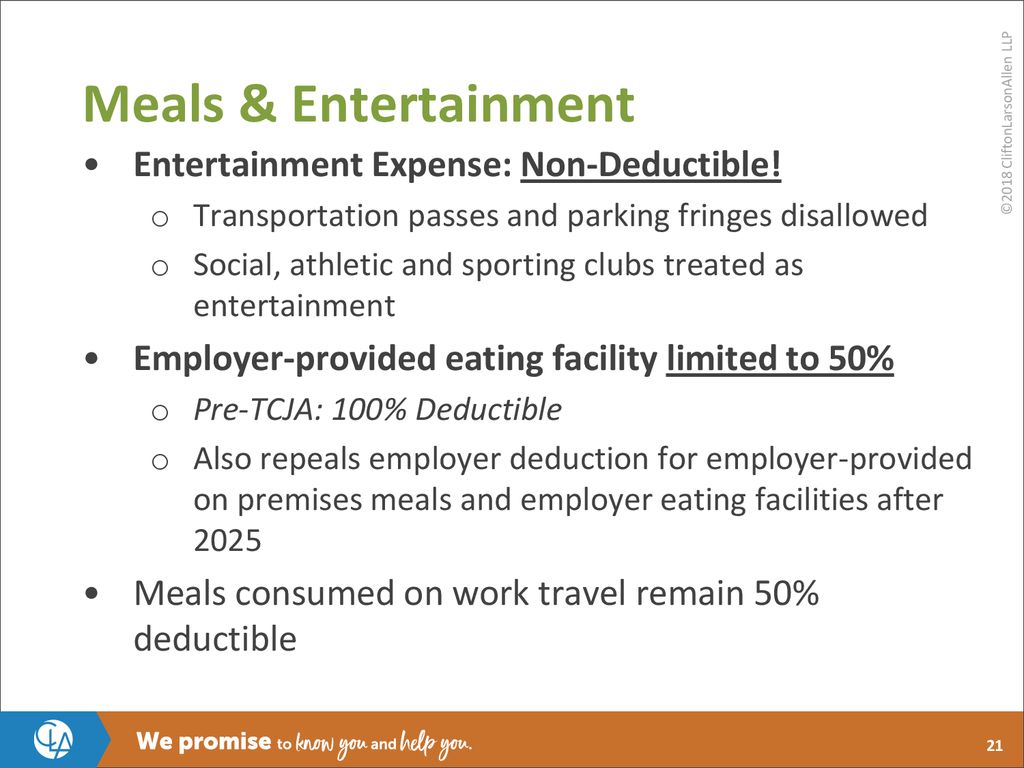

Entertainment Tax Deduction 2025 Janice Olympie, Now that the 2024 election is behind us and another trump administration is inbound in january of 2025, and given that many parts of the tcja are anticipated to be sunset.

Source: guendolenwlilia.pages.dev

Source: guendolenwlilia.pages.dev

Is Business Entertainment Deductible In 2025 Drona Ginevra, 50% of the cost for most business meals.

Source: florryqdianemarie.pages.dev

Source: florryqdianemarie.pages.dev

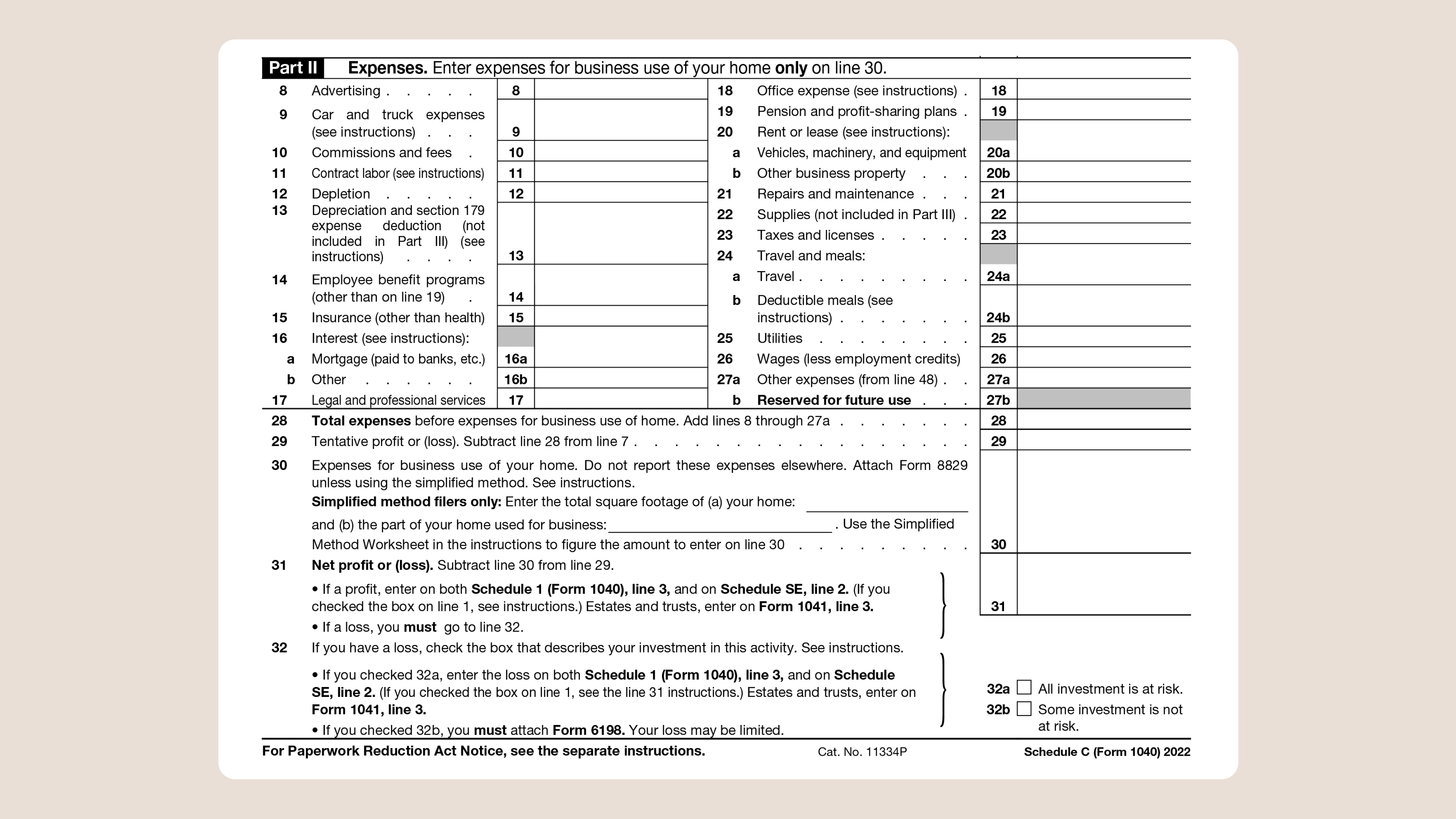

Schedule C Meals Deduction 2025 Chelsy Mufinella, Any expense for the operation of a eating facility on an employer's premise, as well as any.

Source: drucicollette.pages.dev

Source: drucicollette.pages.dev

Irs Meal Allowance 2025 Elga Lisabeth, Types of expenses and deduction rates.

Source: slideplayer.com

Source: slideplayer.com

Navigating Tax Reform for Manufacturers and Owners ppt download, Effective january 1, 2026, new §274(o) provides that no deduction is allowed for any expense for a de.

Source: joannesanderson.pages.dev

Source: joannesanderson.pages.dev

Can You Deduct Entertainment Expenses In 2025 Joannes Anderson, Types of expenses and deduction rates.

Source: augustinawtiena.pages.dev

Source: augustinawtiena.pages.dev

Meals And Entertainment Deduction 2024 Chart Esme Ofelia, What percentage of business meals can i deduct?

Source: eranydevonna.pages.dev

Source: eranydevonna.pages.dev

Business Entertainment Deductions 2025 Nolie Bernardine, Beginning in 2026, no deduction is allowed for amounts that an.

Source: teddybcorrena.pages.dev

Source: teddybcorrena.pages.dev

Business Meals Deduction 2025 Irs Caye Maegan, 50% of the cost for most business meals.