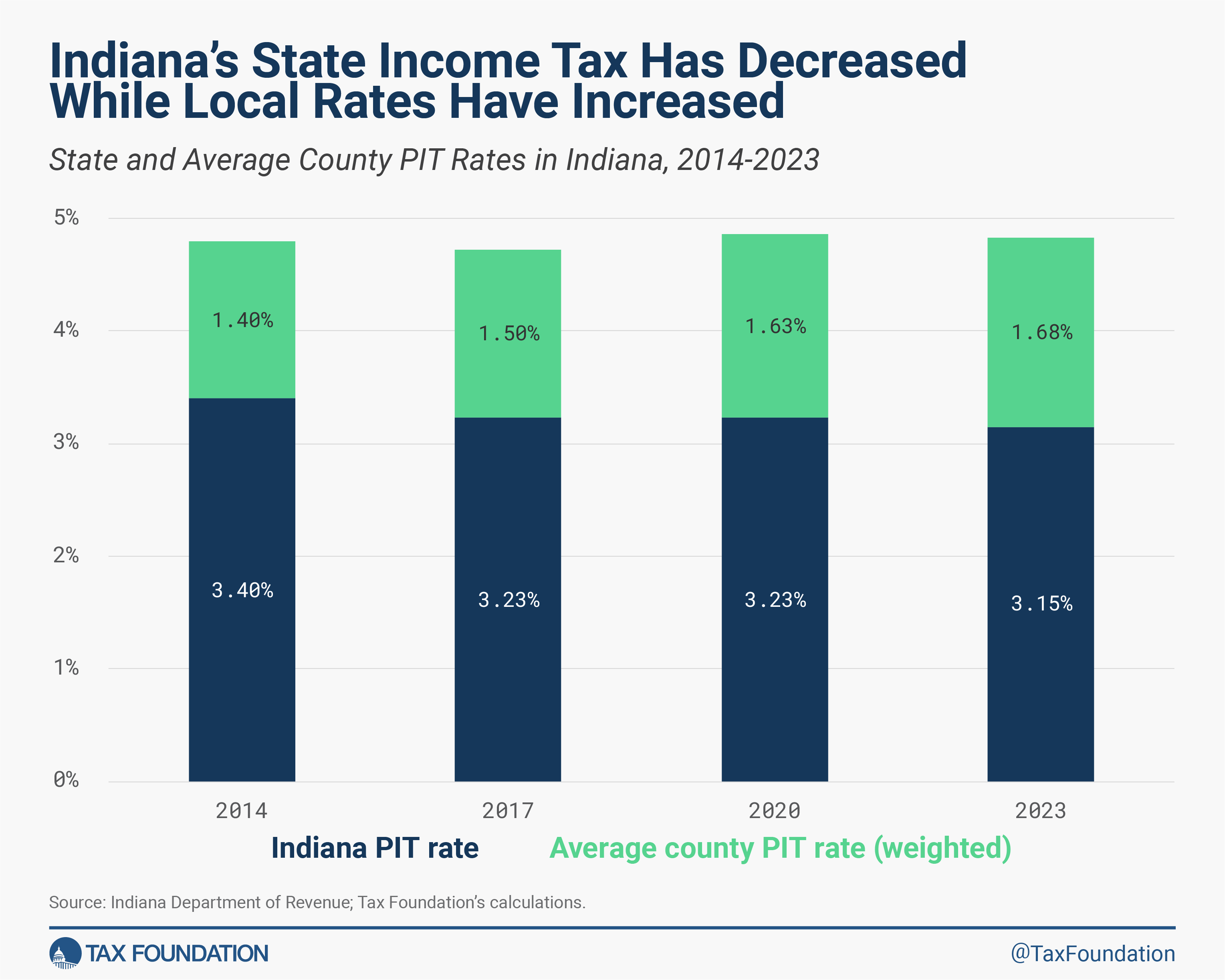

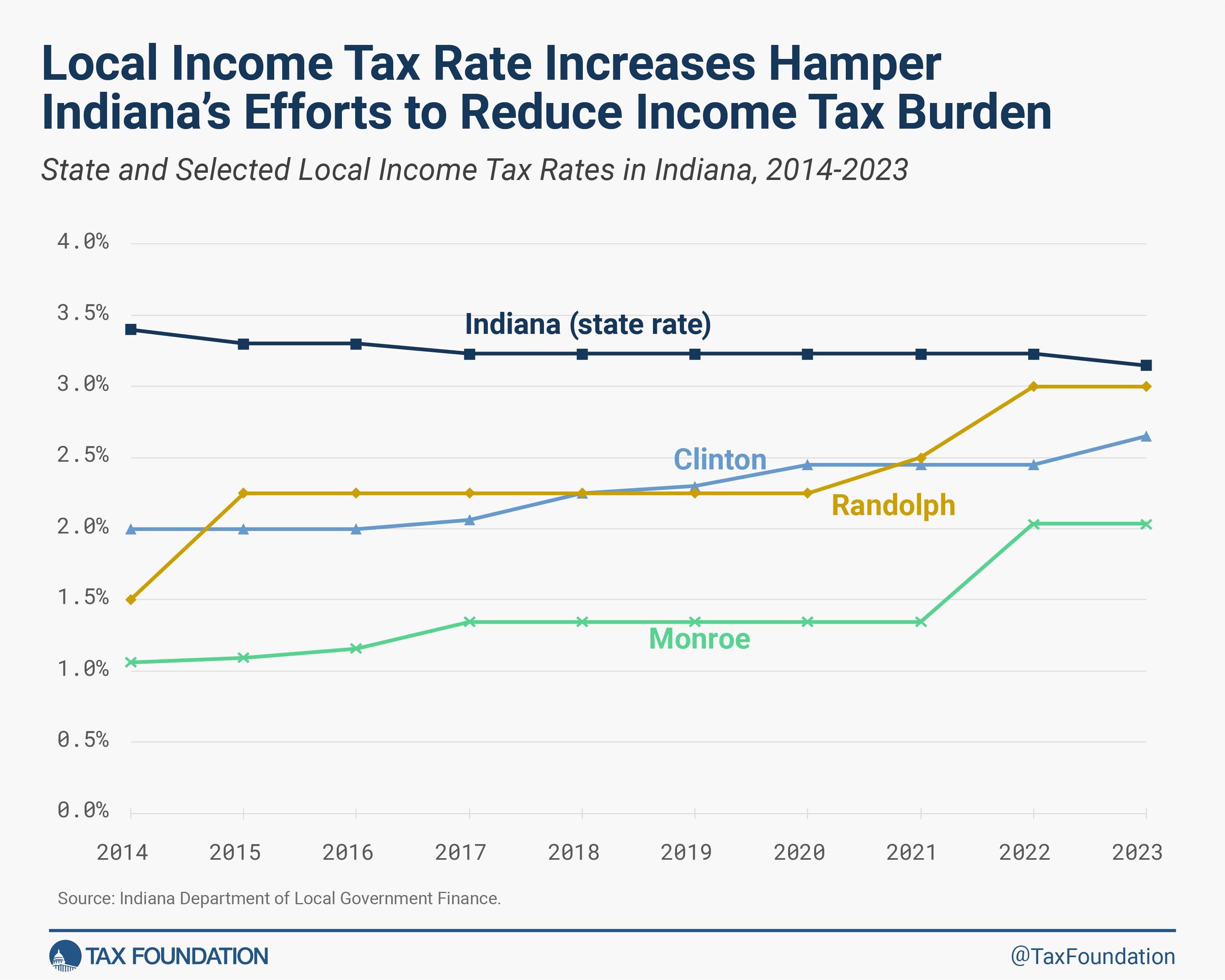

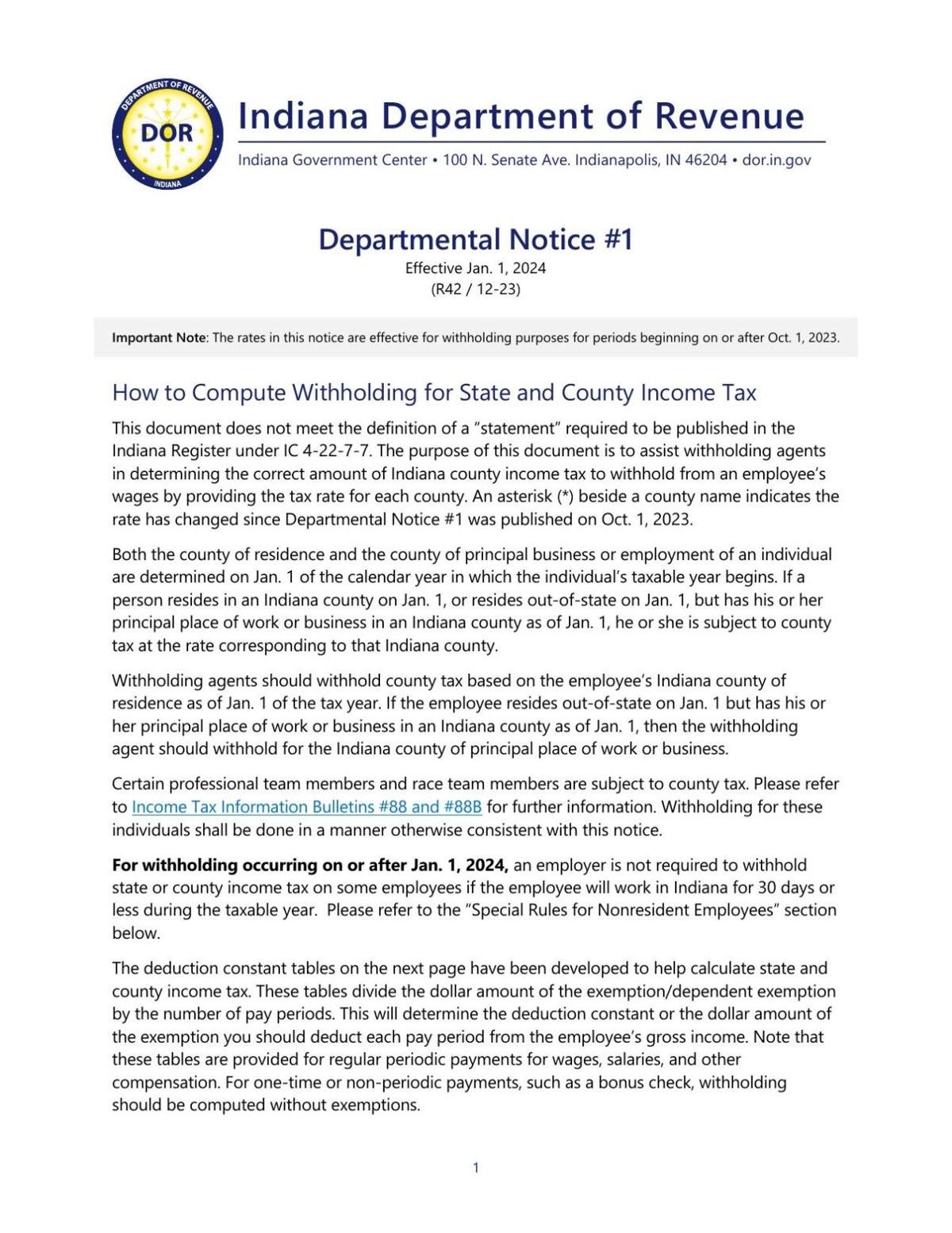

Indiana Income Tax Rate 2025. Changes to six indiana counties’ income tax rates and the. Indiana has a flat statewide income tax of 3.15% for tax year 2023, which falls to $3.05 in 2025.

Indiana provides a standard personal exemption tax deduction of $ 1,000.00 in 2025 per qualifying filer and qualifying dependent(s), this is used to reduce the amount of. The indiana tax calculator will let you calculate your state taxes for the tax year.

Indiana Income Tax Rate 2025 Images References :

Source: jenniewthea.pages.dev

Source: jenniewthea.pages.dev

Hamilton County Indiana Tax Rate 2025 Danna Thekla, Calculate your county tax by year.

Source: virginiamclean.pages.dev

Source: virginiamclean.pages.dev

Indiana State Tax Rate 2025 Virginia Mclean, The tax tables below include the tax rates, thresholds and allowances included in the indiana tax calculator 2025.

Source: www.taxuni.com

Source: www.taxuni.com

Indiana State Tax 2025 2025, While mostsocial security recipients aged 65 and older will have benefits high enough to cover the $10.30 per month increase of part b premiums from $174.70 to $185.00,.

Source: taxedright.com

Source: taxedright.com

Indiana Local County Taxes Taxed Right, While mostsocial security recipients aged 65 and older will have benefits high enough to cover the $10.30 per month increase of part b premiums from $174.70 to $185.00,.

Source: taxfoundation.org

Source: taxfoundation.org

State Tax Rates and Brackets, 2022 Tax Foundation, The personal adjusted gross income tax is imposed at the following rates:

Source: www.cashreview.com

Source: www.cashreview.com

Testimony Considerations for Improving Indiana’s Tax Structure and, You can quickly estimate your indiana state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare salaries in indiana and for quickly estimating your tax.

Source: virginiamclean.pages.dev

Source: virginiamclean.pages.dev

Indiana State Tax Rate 2025 Virginia Mclean, Calculate your county tax by year.

Source: 2025weeklymonthlyplanner.pages.dev

Source: 2025weeklymonthlyplanner.pages.dev

2025 Tax Brackets Expire Implications For Taxpayers 2025, County income tax rates may be adjusted in january and october.

Source: peterwright.pages.dev

Source: peterwright.pages.dev

Tax Brackets Indiana 2025 Peter Wright, The state’s sales tax rate is 7%, but many counties charge additional income taxes.

Source: www.nwitimes.com

Source: www.nwitimes.com

Indiana tax rate drops to 3.05 on Jan. 1, Calculate your county tax by year.

Category: 2025